Daily Energy Report

OPEC+ and V8 decisions, Russia/India oil trade, Winter and energy costs, Biden’s LNG pause, China solar glut, Oilfield services consolidation, Innovation for wind & solar waste, and more.

Here is a recording of a Spaces discussion Dr. Anas Alhajji had on X earlier today that explains OPEC+ and the V8 cuts, prospects for President Trump‘s “Drill Baby, Drill” position, Trump’s enforcement of sanctions on Iran, and the Turkish oil sanctions on Israel. This is in lieu of the Chart of the Day:

The Impact of OPEC+ and V8 Decisions on the Global Oil Market:

https://x.com/anasalhajji/status/1864686083516072297

Related News:

Reuters: OPEC+ Delays Oil Output Hike until April, Extends Cuts into 2026

DER: OPEC+ and the V8 Surprises: Cuts Extended

Story of the Day

Reuters: Rising Costs Squeeze Intermediaries Out of Thriving Russian Oil Trade with India

Summary

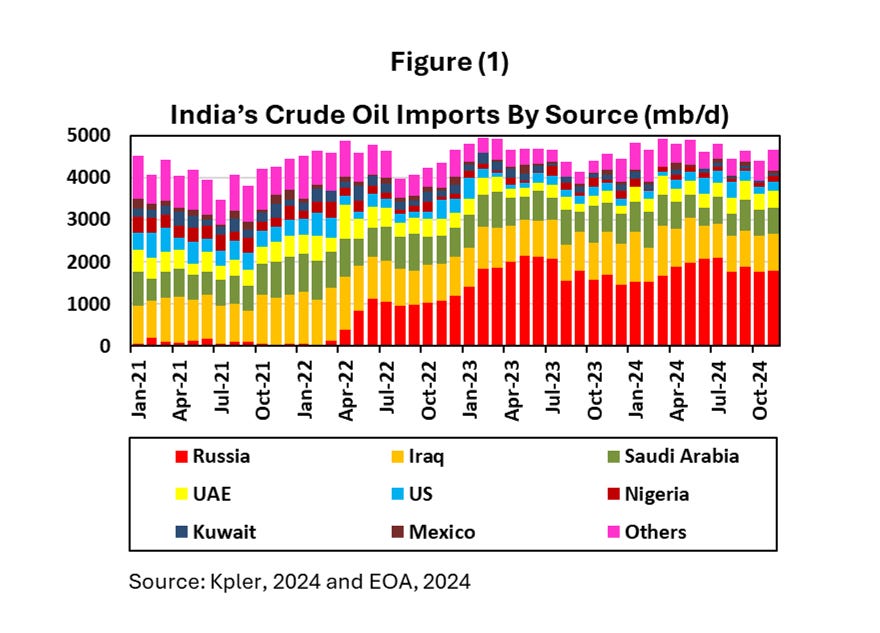

A few firms, including Lukoil's Litasco, now dominate Russian oil exports to India, which imports 1.8 to 2 mb/d, over a third of its crude. Consolidation has reduced discounts on Russian oil to $3-$4 per barrel, keeping it cheaper than US and Middle Eastern grades. High Russian interest rates and prepayment demands have pushed smaller traders out. Despite tighter pricing, Russian oil remains attractive, with exports to India at record highs, surpassing those to China.

Figure (1) shows trends in Russian crude exports to India since 2021. The shift in Russia’s crude exports from Europe to India is stunning. The question is: If President Trump can end the war in Ukraine, what will happen to India’s imports from Russia? After oil, Russians are not going to leave money on the table for others to take