EOA Daily Energy Report

Dear Readers: Starting tomorrow, the Daily Energy Report will go behind the paywall. For $420 per year, you will get the Daily Energy Report during the working days of the week throughout the year.

Thank You

EOA Team

CHART OF THE DAY

Figure (1)

US Natural Gas Exports (Bcf per month)

Source: EIA, 2023 and EOA, 2023

US LNG exports have increased, surpassing natural gas pipeline exports, and they are expected to hit a record high in 2023 especially once the Freeport LNG export plant starts producing at full capacity later this year. The rise in US LNG exports is expected to be bullish for US natural gas, especially during peak summer and winter months.

While the increase in global LNG capacity and exports may sound bearish for the LNG market, the outcome depends on global demand, which in its turn is influenced by weather conditions and economic activity. A cold winter season amid a full economic recovery in China will be bullish for the LNG market despite all new LNG projects.

STORY OF THE DAY

REUTERS: Russia's fuel exports fall 10% in Feb 1-12 - Refinitiv data and traders

Summary: Reuters today reported that Russia’s seaborne oil product exports in Feb 1-12 dropped by 10% compared to the same period last month, blaming the fall on EU sanctions, closure of ports due to inclement weather conditions, and a lack of available ships.

EOA’s Main Takeaway: The EU and G7 sanctions went into effect on Feb 5, so it’s still too early to tell if the decline is driven by the recent western restrictions on Russian oil exports. Additionally, and given that operations at the Black Sea ports of Novorossiysk and Tuapse were suspended for 5-6 days due to inclement weather conditions, it is most likely that the drop in oil product exports has been due to the weather conditions more than anything else.

NEWS OF THE DAY

1- TASS: Russia to send over 80% of oil exports, 75% of oil products to friendly countries in 2023

EOA’s Main Takeaway: This is not the first time Moscow has made such statements, which evoke memories of the oil embargo in October 1973 when some Arab states tried and failed to divide the world into friendly, neutral, and none-friendly nations.

Russian oil will continue to flow in different directions in the global market, and “oil laundering” is the name of the game this year.

2- BLOOMBERG: Russia’s Crude Shipments Slump Ahead of March Output Cut

EOA’s Main Takeaway: It is too early to tell what exactly caused the decline, especially after a significant and surprising increase in crude exports in the past months. We believe that some of the declines is not real as the number of ghost tankers has been rising.

3- TASS: Russian cabinet proposes bill to set Urals oil price for tax purposes

EOA’s Main Takeaway: We interpret this as a political posturing more than an actual policy intended to preserve tax revenues. Russian President Vladimir Putin cannot levy more taxes on oil companies while oil prices are declining, and as he seeks to maintain oil exports.

The impact of this measure on the global oil market is limited. The discount is close to the market discount and is expected to decline as more ships carry Russian oil, especially amid reports that Chinese owners were the "biggest spenders on secondhand vessels" last year, surpassing Greek companies.

4- ENERGY INTELLIGENCE: Russia’s Oil Income Takes a Hit

EOA’S Main Takeaway: There’s no doubt that Russian oil revenues have declined. But what was the main cause? EU and US claim that the G7-led price cap(s) have caused it are politically motivated. The price cap has no impact on oil prices, production, or exports.

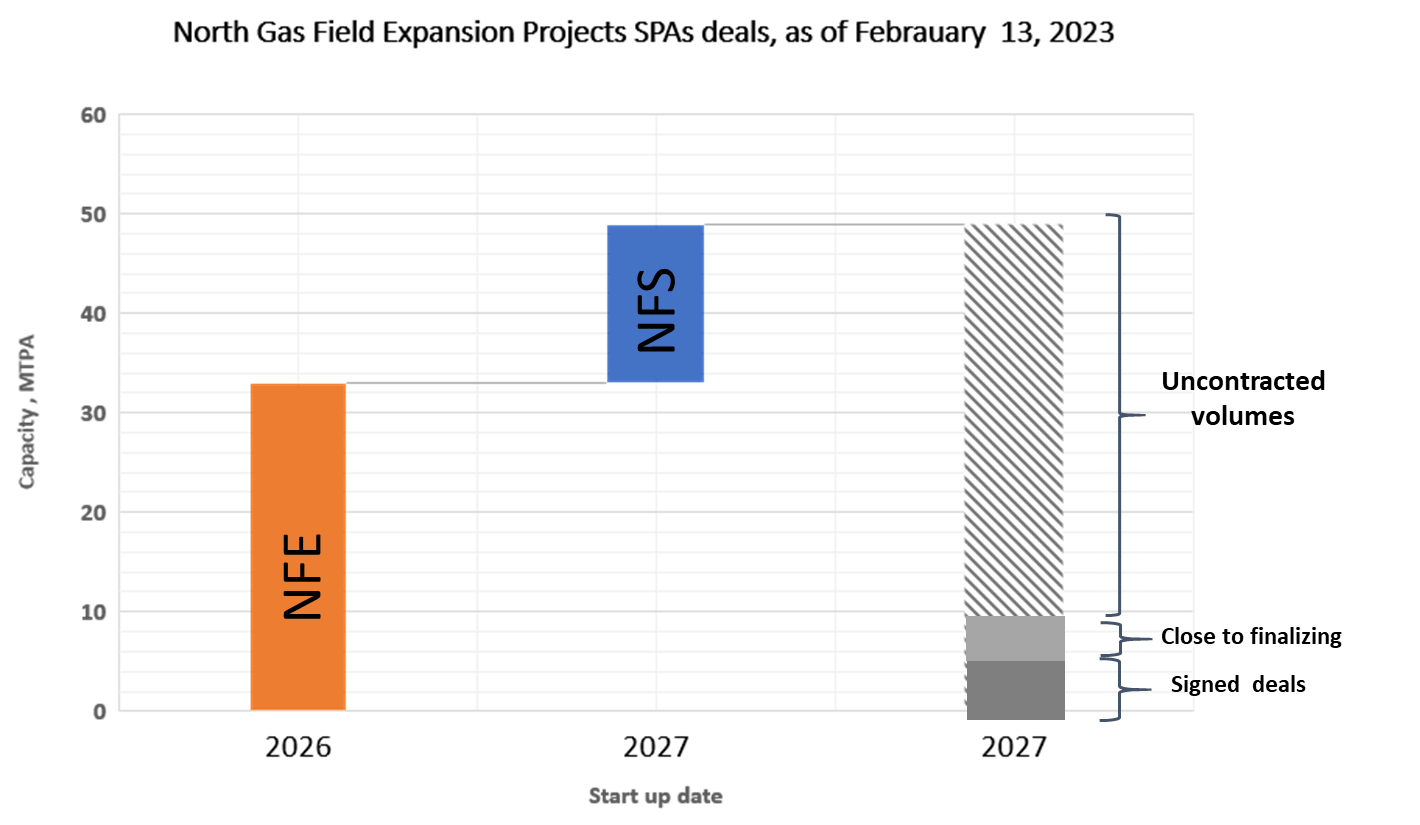

5- REUTERS: Exclusive: China's CNPC set to seal mega Qatari LNG deal - sources

EOA’s Main Takeaway: This is another major win for QatarEnergy. In our first issue of the Weekly Newsletter in December 2022, we noted that the largest single LNG sales and purchase agreement (SPA) in the LNG industry was struck when QatarEnergy secured late last year a significant deal with China’s Sinopec, under which Qatar will supply the giant Chinese firm with 4 million tons per annum (mtpa) starting in 2026 and for a 27-year period. We also said that Qatar needed to continue hard talks with other potential European and Asian customers to secure the sale of remaining uncontracted volumes of the North Field Expansion projects. We encourage readers to read more on this significant development in our Weekly Newsletter here.

This new deal, if sealed, would be marked as another historic one in the LNG industry in terms of contract duration. It’s obvious that Qatar wants long-term contracts and to maintain its dominance in the global energy market for decades to come.

In this deal, Qatar secured the sale of 10 MTPA of LNG or 21% of the North Field Expansion capacity. Still, Qatar has to continue hard talks and negotiations with other potential European and Asian customers to secure the sale of remaining uncontracted volumes as shown in Figure (2).

Figure (2)

Source: Company announcements, 2022-2023 and EOA, 20023

6- REUTERS: PetroChina completes drilling Asia's deepest oil well in Sichuan province

EOA’s Main Takeaway: We see this as a great success for PetroChina. Sadly, production will only cover the decline in Chinese oil production, and no amount of discoveries will be enough to quench China’s thirst for oil imports.

7- BLOOMBERG: Tanker Loadings of Azeri Oil Resume at Turkey’s Ceyhan Terminal

EOA’s Main Takeaway: On February 9, we said that the impact was going to be regional and will be felt mostly in countries that depend on importing oil from Ceyhan. This development has no impact on the global oil market.

8- S&P GLOBAL: Freeport LNG in US exports first cargo since June 2022 fire: vessel tracking

EOA’s Main Takeaway: As we noted in the Chart of the Day above, US LNG exports are expected to reach a record high this year especially once the Freeport LNG export plant starts producing at full capacity.

9- FINANCIAL TIMES: Cash-rich US oil producers hunt for deals after long M&A dry spell

EOA’s Main Takeaway: It remains to be seen whether we will have a big wave of M&A (Mergers and Acquisitions), especially considering active boards, environmental, social and governance (ESG) rules, and hostile governments. Mergers of equals are more likely than whales eating small fish.